A tax trigger aimed to replace the current complex structure of multiple indirect taxes in favour of a comprehensive dual Goods and Services Tax (GST) is becoming a reality. With clear road map being laid down by the Finance Ministry, the Government seems on course to fast-track the entire process to achieve targeted GST implementation effective 1 July 2017.

The Central Government enacted four GST Bills:

Central GST (CGST)

Integrated GST (IGST)

Union Territory GST (UTGST)

Bill to the Compensate States

What is SGST, CGST & IGST?

Goods & Service Tax or GST will be levied on goods and services. It will replace all the various taxes and bring them under one umbrella to make compliance easier. It will replace the following taxes:

(i) Taxes currently levied and collected by the Centre:

1.Central Excise duty

2. Additional Duties of Customs (commonly known as CVD)

3.Special Additional Duty of Customs (SAD)

4.Service Tax

AND

(ii) Taxes currently levied and collected by the State:

1.State VAT

2.Central Sales Tax

3.Entertainment and Amusement Tax (except when levied by the local bodies)

Taxes on lotteries, betting and gambling

Union territories with the legislature, i.e., Delhi & Puducherry, will adopt SGST Act and the balance 5 Union territories without legislatures will adopt UTGST Act.

The second phase of enrolment process for migrating existing taxpayers to the proposed tax regime through GST common portal has already commenced from 1 June 2017. GST Network, an IT backbone of GST, has also carried out the test run of its Portal.

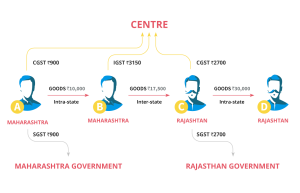

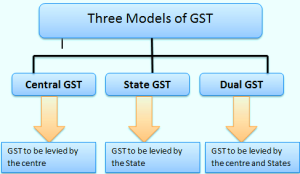

India is a federal country where both the Centre and the States have been assigned the powers to levy and collect taxes. Both the levels of Government have distinct responsibilities to perform, as per the Constitution, for which they need to raise resources. A dual GST will, therefore, be keeping with the Constitutional requirement of fiscal federalism.

The Centre and States will be simultaneously levying GST.

3 taxes will be implemented to help taxpayers to take a credit against each other thus ensuring “One nation one tax”.

The GST Council consisting of representatives from the Central as well as state Government met on sixteen occasions in last seven months and cleared –

GST laws,

GST Rules,

Tax rate structure including Compensation Cess,

Classification of goods and services into different rate slabs,

Exemptions,

Thresholds,

Tax administration